From beginners in the 2G era, to followers of foreign companies in the 3G era, active participants and independent innovators of mainstream communication standards in the 4G era, and to leaders in the 5G era, Chinese technology companies have finally taken the lead in the global game of communications standards.

The influence of a company in the communications sector mainly depends on its contribution to communications standards and the number of communications patents it holds. What's behind it, however, is actually the company's R&D capacity in communications.

In this paper, we, as a third-party, from perspectives including the distribution of granted 5G standard essential patents (SEPs) and changes in their year-on-year growth, will learn more about companies that engage in the formulation of 5G standards, including what kind of SEPs they hold, and analyze the future of the global communications sector, as well as the roles that Chinese companies will play in it.

5G standard: who hold the most core 5G patents?

In the communications sector, whether a company is influential mainly depends on its contribution to the development of communications standards and the number of patents it holds. These two factors can also determine who play the leading roles in the 5G era.

In recent years, many global players in the mobile communications sector, including but not limited to network and communication chips manufacturers and telecommunication operators, have been actively engaged in formulating 5G standards. In the midst of driving forward 5G standard formulation and commercialization, communications companies, one after another, have been declaring their own 5G SEPs and 5G standard related patents.

We have previously analyzed the number of applications for 5G SEPs and 5G standard related patents declared on ETSI (European Telecommunications Standards Institute). Declaring a patent on ETSI by following its standard patent declaration procedure, which is an open process, is the first step for determining 5G SEPs or 5G standard related patents. Whether these declared patents and patent applications can finally be granted, and whether they are still essential standards after adjustments in the granting process, require further verification. Therefore, the numbers of applications for 5G SEPs and 5G standard related patents declared on ETSI are the preliminary data for analyzing the engagement and leadership of a company in the 5G sector, although more accurate conclusions won't be drawn without further in-depth and case-by-case analysis of other factors such as the value and the granting status of these patents.

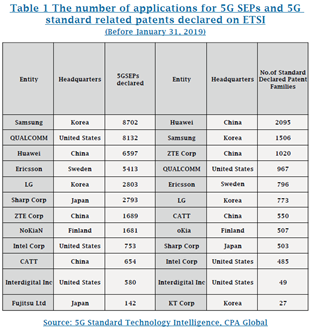

Recently, CPA Global, a world-renowned intellectual property service provider, has counted the number of 5G standard essential patents and 5G standard related patent applications declared on ETSI before January 31, 2019, and from the perspectives of the time of filing, the holders, distribution areas, and granted 5G standard patents. It also analyzed whether the 5G standard required patents declared by each enterprise pertain to 5G new technology or 3G/4G inheritance technology. Initial data revealed that Samsung was quantitatively the largest holder of 5G SEPs, followed by Qualcomm, Huawei, Ericsson, and LG; based on family information of 5G SEPs declared on ETSI, Huawei becomes the largest holder, followed by Samsung, ZTE, Qualcomm, and Ericsson.

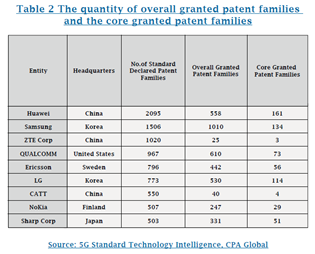

CPA Global further counted the top 9 companies with the largest number of 5G SEP families based on the number of overall granted patent families and core granted patent families, and obtained the following data: companies with the largest number of overall patent granted families are Samsung, Qualcomm, and Huawei in descending order; while companies with the largest number of core granted patent families are Huawei, Samsung, and LG in descending order (see Table 2).

The number of overall granted patent families is an important indicator to measure the contribution that a company has made to 5G standard formulation, as well as the company's role in the 5G era. According to the above statistics, Huawei has outperformed other participants in terms of the number of core granted patent families.

Weakening influence of European and Korean companies in 5G era

Some 5G technologies overlap with 3G/4G. Therefore, further investigation of whether a 5G SEP is inherited from an existing 3G/4G technology, or is related to new technologies specifically pertaining to 5G, is crucial to measurement of a company's contribution and role in the 5G era.

For a 5G SEP declared by a company, the application time roughly reflects its technical relevance, i.e. whether it overlaps with a 3G/4G technology, or is related to new technology of the 5G era. Among them, patent families prior to 2010 are basically legacy technologies carried forward from previous generations of technologies. 5G patents dated after 2010, especially from 2010 to 2014 (a significant phase when basic studies of 5G core technologies were accumulated), are of the highest value. This period also contains some proportion of legacy technologies, as this period marks the transition from 4G to 5G development.

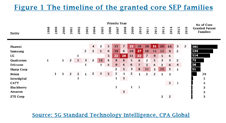

In the 5G Standard Technology Intelligence report, CPA Global analyzed the core granted patent families of the top 12 companies from the time dimension, and achieved the timeline of the granted core SEP families (based on the earliest publication time of the granted patent families).

According to the timeline of the patent declaration data as shown in Figure 1, most core granted patent families of the 12 companies were declared in the period from 1998 to 2016. Among them, the declaration time of core granted patent families of Huawei, Samsung and LG mainly fall in the periods of 2009-2014, 2007-2013 and 2007-2010, respectively. The core granted patent families of Qualcomm and Ericsson were mainly declared before 2010.

According to the 5G standard related chapters for patent declaration on ETSI, we can tell whether a patent is a new 5G technology or overlaps with a 3G/4G technology.

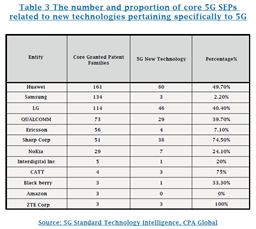

According to the statistics, Huawei, LG, Sharp, and Qualcomm have obvious advantages in the number of essential patents with the core standards required for new 5G technologies, while Samsung, Ericsson, Nokia and other companies still rely on the original 3G/4G technical patents. Core 5G SEPs pertaining to 5G new technologies owned by Samsung, Ericsson, Nokia and other companies are relatively small in absolute number, and account for only a small proportion in the core 5G SEPs owned by themselves (see Table 3).

By analyzing data such as the number of reporters sent by major companies and technology proposals submitted, IHS Markit, a well-known British data company, summarized the changes in the contribution and R&D investment of each company in the 4G to 5G development process in the report "Who Leads the Mobile Infrastructure Race?". Tables 4 and 5 show the number of LTE/EPC (4G network) reporters and LTE/EPC proposals, as well as the number of 5G reporters and proposals submitted by major companies in the first quarters from 2015 to 2018.

The above statistics show that from 4G to 5G, Ericsson, Nokia, Samsung and other companies' number/proportion of reporters and standard proposals all significantly declined. This change in data should be related to the decline in these companies' investment in the 5G sector.

5G embraces historic development opportunity with the rise of Chinese technology companies

Although we cannot measure the value of 5G patents merely based on the quantity of patents due to the existence of multiple factors affecting the value of patents, the number of core 5G SEPs largely reflects a company's investment in R&D, and to a certain extent determines its role in the 5G era. The number of core 5G SEPs actually reflects a company's investment in the R&D of 5G communication.

Today, the core 5G SEPs around the world have gathered in a few companies such as Huawei, Samsung, LG, Qualcomm, and Ericsson. In the end, these companies will gradually have a "say" in global communication standards and eventually lead the industry.

As one of the core members in 5G era, Chinese companies have been increasing their investment in 5G innovation and participating more in the formulation of global communication standards over the recent years.

Taking the R&D investment in 5G as an example, Huawei, a Chinese company, started the research on 5G ten years ago. In 2009, Huawei invested USD 600 million to initiate the research on 5G technologies and standards. In 2016, Huawei added USD 1.4 billion to accelerate the development of end-to-end 5G commercial products. So far, Huawei's investment in the R&D of 5G has exceeded the total investment of major equipment suppliers in the US and Europe.

Take 5G participants as an example. Huawei, China Mobile, China Unicom, China Telecom, and ZTE account for one third of the 15 companies with the largest number of 5G reporters. Among them, Huawei has the largest number of reporters (28) in the world.

Take the number of 5G proposals as an example. Among the top 8 global companies that have submitted the most 5G technology proposals, Huawei and Ericsson are in the leading position. Huawei contributes 15% for 5G technologies, ranking the first.

Furthermore, as of April 2019, the number of 5G SEPs and 5G standard related patents that Chinese companies applied for accounted for 34% of the global applications, ranking the first in the world. Among them, Huawei accounted for 15.05%, ranking the first.

While Chinese companies have contributed to the entire information and communication industry and promoted its rapid development, they have also established their leading position in the global communication industry. For instance, in terms of technical standards, the 5G concepts, application scenarios, and technical indicators advocated by China have been included in the definition of 5G by the International Telecommunication Union (ITU), and key technologies such as flexible system design, polarization codes, and new network architectures proposed by Chinese companies have become the focus of international standards. In terms of industrial development, China took the lead to launch the R&D trials on 5G technologies, accelerating the R&D progress of 5G devices and industrialization of 5G technologies. At present, China's 5G mid-band system devices, terminal chips, and smart phones are in the highest echelons of the industry around the world.

With 2019 being the first year of 5G commercialization in China, the main links in China's 5G technology industry chain have reached the commercial level.

According to the 2019 China Mobile's Economic Development Report released by GSMA (Global System for Mobile Communications Alliance), China is expected to become one of the world's leading 5G markets, and to have 460 million 5G connections by the end of 2025, accounting for 28% of total connections. By that time, the number of China's 5G connections will exceed the total number of connections in North America and Europe, ranking the first in the world.

From beginners in the 2G era, to followers of foreign companies in the 3G era, active participants and independent innovators of mainstream communication standards in the 4G era, and to leaders in the 5G era, Chinese technology companies have finally taken the lead in the global game of communications standards.

About the Authors:

Zheng Youde

Guangdong Zhicheng Intellectual Property Rights Research Institute

Wang Huotao

Guangdong Zhicheng Intellectual Property Rights Research Institute

Li Fushan

Guangdong Zhicheng Intellectual Property Rights Research Institute

Wen Yan

Guangdong Zhicheng Intellectual Property Rights Research Institute

Source: China IP Magazine, Issue 94