The Global Innovation Index (GII) reports released by the World Intellectual Property Organization (WIPO) rank global science and technology (S&T) innovation clusters by two indicators: the number of PCT patent applications and the number of scientific publications. A review of the reports dating to 2017 reveals that Tokyo-Yokohama has been the top S&T innovation cluster in the world, followed by Shenzhen-Hong Kong-Guangzhou. Beijing rose from the seventh place in 2017 to the third place in 2021 and maintained the record in 2022.

Based on the GII reports, the Counsellors Office of Beijing Municipal People's Government and Cloud River Urban Research Institute jointly published a report that makes a comprehensive comparison of the three S&T clusters and further discusses the innovation strengths and weaknesses of Beijing. The report finds the following innovation trends:

I. Respective strengths of the three clusters in patent applications and scientific publications

1.1 Tokyo-Yokohama: patent applications more active than scientific publications

Tokyo-Yokohama leads in PCT patent applications. The number of PCT patent applications in Tokyo-Yokohama has risen from 104, 746 in 2018 to 122,526 in 2022, topping the world. However, the number of scientific papers in Tokyo-Yokohama dropped by 20 percent during the same period, with its ranking down from the second to the fifth place.

Tokyo-Yokohama sees more active patent applications than scientific publications. The growth of this cluster is driven by the close interaction between its scientific research and industry.

1.2 Shenzhen-Hong Kong-Guangzhou: patent applications and scientific publications are both surging

The number of patent applications and the number of scientific papers are both surging in Shenzhen-Hong Kong-Guangzhou. The number of PCT patent applications in Shenzhen-Hong Kong-Guangzhou doubled from 2018 to 2022, with the gap with that of Tokyo-Yokohama significantly narrowed. Meanwhile, the number of scientific papers tripled from 2018 to 2022, surpassing Tokyo-Yokohama and ranking third globally.

Shenzhen-Hong Kong-Guangzhou is experiencing such a surging growth that it poses threat to the Tokyo-Yokohama cluster.

1.3 Beijing: Beijing leads in scientific publications

Beijing takes significant lead in scientific publications. The global proportion of Beijing’s scientific papers increased by 24 percent from 2018 to 2022, ranking first steadily. However, Beijing is relatively lagging in patent applications. In 2022, its global share of patent applications ranks sixth.

Beijing’s improving performance in the GII S&T cluster ranking is largely contributed by the significant increase in its scientific publications.

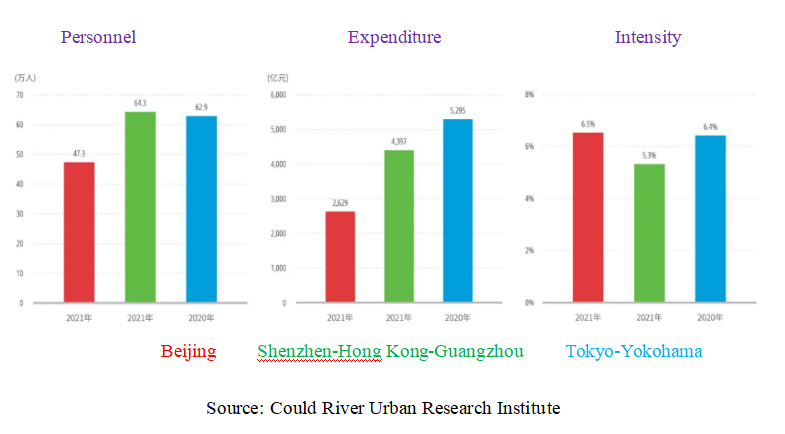

II. Beijing sees the highest R&D intensity while the least R&D expenditure and personnel

2.1 R&D expenditure: Beijing spends the least on R&D

Among the three clusters, Tokyo-Yokohama spends the most (529.5 billion yuan) on research and development (R&D), 1.2 times that of Shenzhen-Hong Kong-Guangzhou and twice that of Beijing.

2.2 R&D intensity: Beijing sees the highest R&D intensity

Beijing sees the highest R&D intensity of 6.5 percent, slightly higher than that of Tokyo-Yokohama and 1.2 percent higher than that of Shenzhen-Hong Kong-Guangzhou.

2.3 R&D personnel: Beijing has the least number of R&D personnel

Beijing has the least number of R&D personnel (473,000), accounting for just around 75 percent that of Shenzhen-Hong Kong-Guangzhou (643,000) and Tokyo-Yokohama (629,000).

2.4 Per capita R&D expenditure: Beijing falls behind

The per capita R&D expenditure of Beijing is 556,000 yuan, taking up only 81 percent that of Shenzhen-Hong Kong-Guangzhou (684,000 yuan) and 66 percent that of Tokyo-Yokohama (842,000 yuan).

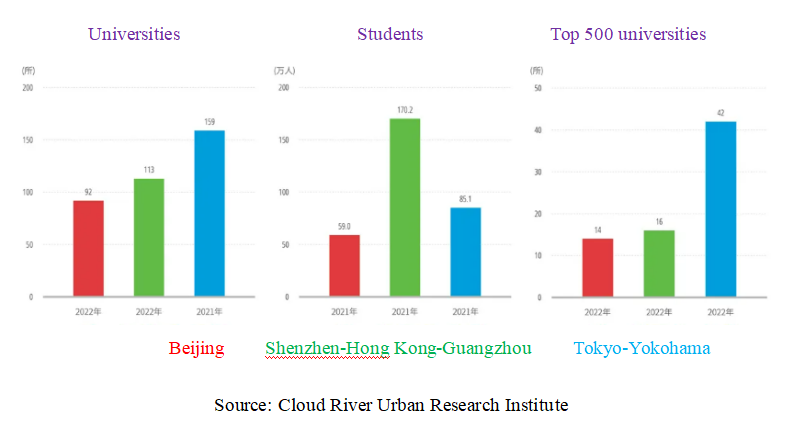

III. Beijing, with the top universities in Asia, holds the least number of universities and students

3.1 The number of Universities: Tokyo-Yokohama holds the highest number of universities

Among the three clusters, Tokyo-Yokohama holds the highest number of universities (159), 1.4 times that of Shenzhen-Hong Kong-Guangzhou (113) and 1.7 times that of Beijing (92).

3.2 The number of university students: Shenzhen-Hong Kong-Guangzhou has the largest number of university students

Shenzhen-Hong Kong-Guangzhou has the largest number of university students (1,702,000), followed by Tokyo-Yokohama (851,000) and Beijing (590,000).

3.3 Beijing, with the top universities in Asia, holds the least number of top 500 universities in the world

Beijing has the top universities in Asia. However, it holds the least number of the top 500 universities in the world. According to the World University Rankings released in Times Higher Education, of the top 500 universities, there are 42 in Tokyo-Yokohama, 16 in Shenzhen-Hong Kong-Guangzhou and only 14 in Beijing.

IV. Beijing is strong in academic research while relatively weak in the interaction between scientific research and industry

Beijing, with great importance attached to innovation, sees the highest R&D intensity among 297 cities at and above the prefecture level in China. Another advantage for Beijing is that it has a large number of well-known universities and top research institution resources, including one-third of the country's state key laboratories and nearly half of the academicians from the Chinese Academy of Sciences and Chinese Academy of Engineering. However, compared with the other two clusters, Beijing is relatively weak in the interaction between scientific research and industry.

V. Conclusion

In light of the strengths and weaknesses of Beijing, the report suggests that Beijing should upgrade its urban infrastructure on a large scale to promote the innovative development of enterprises in the fields of new energy, road trams and other new urban rail transit systems, new energy-saving buildings, etc. With this approach, there will be a more efficient transformation of scientific research achievements into products and services, which will further drive the development of this cluster.